A barrage of tariff letters sent to over 20 countries by President Trump yielded very little movement in the financial markets. Trump announced that there would not be additional extensions to negotiations and that tariff levels sent in these letters would go into effect on August 1st. Japan and South Korea levies were set at 25%, Brazil at 50%, Canada at 35%, the EU at 30%, and Mexico at 30%. The EU and Mexican letters were penned on Friday but sent Saturday morning. President Trump also imposed a 50% tariff on copper and suggested a 200% levy on pharmaceuticals. I was surprised the market did not react more negatively to these letters. However, there is still time for negotiations, and several leaders indicated they would diligently work with the Trump trade delegation to establish lower tariff levels.

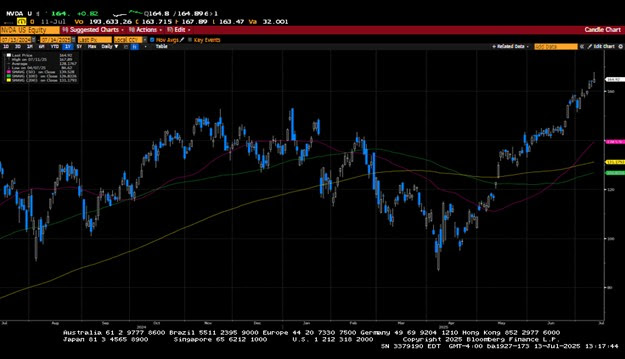

NVidia shares rallied, and the company eclipsed a market cap of $4 trillion. It’s the first company to have a market cap above that threshold. Microsoft is a close 2nd with a market cap of $3.75 trillion. Notably, the Magnificent Seven now account for 40% of the S&P 500’s market cap. Delta Airlines posted better-than-expected 2nd quarter earnings. The news sent shares higher and provided a lift for the airline sector. The energy sector outperformed, along with the utility sector, while the information technology and consumer staple sectors underperformed. In the coming week, 2nd quarter earnings will start in earnest with several banks set to report.

The S&P 500 shed 0.3%, the Dow gave back 1%, the NASDAQ was off by 0.1%, and the Russell 2000 lost 0.5%. US Treasuries posted a second week of losses. $119 billion in Treasuries were auctioned this week with okay results. It was noticeable at all three auctions that there was lower participation from foreign investors. The 2-year yield increased by three basis points to 3.91%, while the 10-year yield rose by eight basis points to 4.42%. Oil prices rose 2.2% or $1.49 to close the week at $68.43 a barrel. Gold prices increased by $25.20 to close at $3,363.80 per ounce. Copper prices rose 8.9% on Trump’s 50% tariff announcement and closed at $5.60 per Lb. Bitcoin’s price hit an all-time high of $119,216. The US Dollar index added 0.7% to close at $97.87.

The S&P 500 rose 1.8%, the Dow gained 2.4%, the NASDAQ added 1.7%, and the Russell 2000 outperformed, rising 3.5%. The S&P 500 and the NASDAQ inked another set of all-time highs this week. US Treasuries were unable to post a 4th week of gains as a stronger-than-expected Employment Situation Report recalibrated expectations for future Fed rate cuts. The report eliminated any chance of a July cut and reduced the probability of a September rate cut to 70% from just over 90%. The 2-year yield increased by fourteen basis points to 3.88%, while the 10-year yield rose by six basis points to 4.35%. Oil prices increased by 2% or $1.37 to close at $66.94 a barrel. Concerns that OPEC+ will increase its production quotas again this weekend will likely keep a lid on prices in the near term. Gold prices increased by $41.80, closing the week at $3,338.60 per ounce. Copper prices rose by seven cents to $5.14 per Lb. Bitcoin’s price was little changed from where it started last week at $107,500.

The economic calendar was pretty quiet last week. NFIB Small Business Optimism fell slightly from the prior level, coming in at 98.6. FOMC minutes did not provide any surprises, but did reiterate that some Fed officials believe a rate cut could be justified at the July meeting. Currently, the probability of a July rate cut sits at 5.2%. Initial Claims fell by 5K to 227k, while Continuing Claims came in unchanged at 1965k. This coming week, we will get a full dose of inflation data with the Consumer and Producer Price Indices. We will also get a look at June Retail Sales, which, given what we saw from Amazon Prime sales, should be resilient. We will also get the first look at July’s Consumer Sentiment.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.